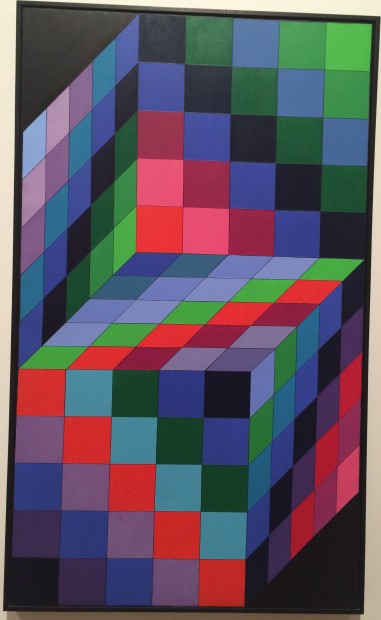

First a picture that’s kind of a mirage.

Georgia O’Keefe, Canyon Country, 1963. Phoenix Art Museum.

Fidelity says

Fidelity Investments recently published their second quarter 2018 Retirement Analysis . Fidelity administers over 30 million retirement accounts, so my suspicion would be that their results should be reflective of the total population of retirement account holders. For the second quarter of 2018, Fidelity found average account balances $104,000 for 401(k)s, $106,900 for IRAs, and $83,400 for 403(b)s.

For millennials, Fidelity determined an average IRA balance of $15,150.

So far, very positive, but there’s more. Fidelity has 168,000 401(k) millionaires and 156,000 IRA millionaires.

Money mirage

You may look at Fidelity’s figures, and possibly your own 401(k) or IRA, and feel reasonably good about the state of retirement savings. You are in a money mirage and seeing what is not real.

What makes the Fidelity figures (or yours!) a mirage has three parts:

- Taxes – in a regular 401(k)/IRA/403(b), you will likely owe taxes on your withdrawals and that makes the money shrink, like water in a mirage as you get closer.

- Price changes – if you are in mutual funds, your amount could go up but it could also go down. If the market goes down, that makes the money shrink, like water in a mirage as you get closer.

- Longevity – the amount may look big, but it may need to last you for a 20 to 30 year retirement. Taking some out, year over year means the money shrinks, like… you get the idea.

Taxes

The problem with taxes on regular 401(k)/IRA/403(b)’s (let’s call them retirement savings), is that the more you withdraw, the more tax you will owe. Not only more tax, but if you withdraw enough from your retirement savings in a year, you may make your Social Security payments subject to tax. Depending on how much your MAGI is, you may make 50% to 85% of your Social Security taxable.

The $62,000 example

Now let’s say you’re a couple (the Example family!) with close to the average Social Security of $1400/person per month or about $33,700/year. The Examples’ budget and retirement income plan (see the RIP here) has them grossing $62,000/year so they will need about $28,300 from their 401(k). Now the mirage hits. The Examples are well over the standard deduction of $20,000 for a married couple, so there will be tax on the 401(k) distribution, plus they will exceed the Social Security MAGI so part of their Social Security benefits will be taxable. I eyeballed it (don’t try this at home if you don’t do a LOT of 1040’s) and it looks like the Examples will have approximately a $1,900 Federal tax liability. The mirage was the $28,300 from the 401(k) that turned out to be about $26,400 after Federal taxes. There may also be state income taxes that shrink the initial amount.

Price changes

If your retirement savings are in a mutual fund (non-money market) and the price goes up, we’re all happy. If the price goes down (remember 2007-2008?), we have the mirage of shrinking fund balances. If you are nearing retirement, this mirage can be a real problem unless you have some cash for the early years of retirement, so you don’t have to sell shares at a low price. Consult your financial planner to have a plan for this.

But I saw it with my own eyes!

We saw Fidelity’s decent average retirement plan balances and the impressive number of retirement plan millionaires, above. But what happens if they live too long?

Your retirement savings balance, like the average balances above, may sound fairly high, but once you start withdrawing funds, your accounts can deplete rapidly. Remember the Example family, above. They were planning to use approximately $28,000 from their retirement plans annually. Unfortunately, if they have an average 401(k) or IRA balance, that will only be possible for about three to four years before they are out of money and living solely on Social Security and any other sources of income.

And here’s a mirage-like Victor Vasarely (Tridim-mc, 1974) from the Phoenix Art Museum:

Actions you can take include:

Develop a retirement income plan and discuss it with your tax advisor and your financial planner.

Know what the tax impact of withdrawals will be to your income.

Manage your retirement budget with your income plan to avoid bad surprises.

And if you have not seen the “Why you should read this blog…WIIFY” post, it’s here

Questions, comments, or suggestions for retirement surprise areas you want to know more about?

-Leave a comment

-Use ‘Contact’, above, to send an email.